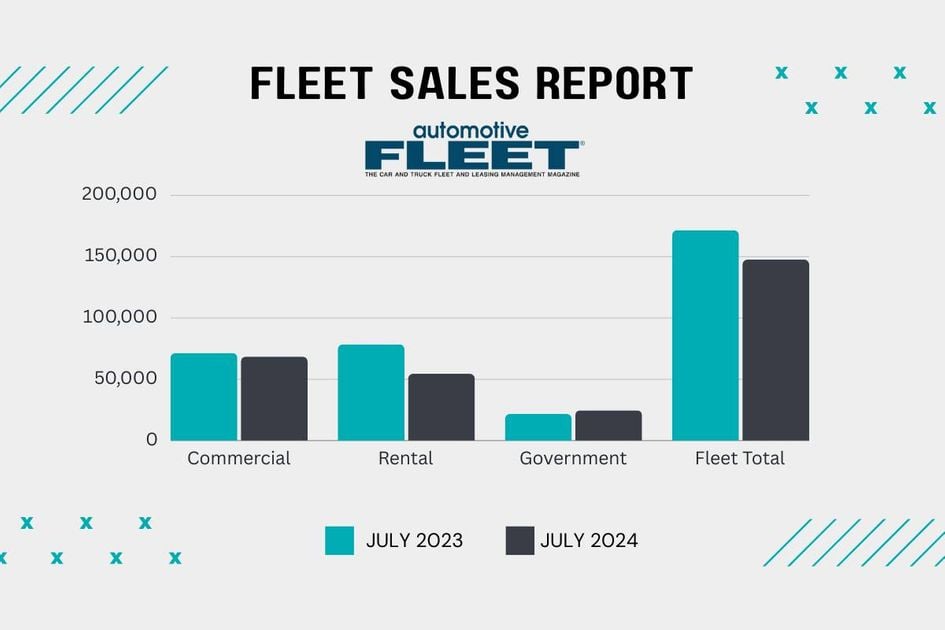

The combined sales for the three fleet sectors in July totaled 147,543 vehicles, down 14% from the July 2023 total of 171,464 fleet vehicle sales.

Combined commercial, rental, and government fleet sales have collectively glided down for most of this year, resulting in a statistical 0% year-over-year tie as of July 31.

Fleet sales for the first seven months of 2024 hit 1,372,187, barely up from the 1,371,577 vehicles sold during the same period of 2023. The miniscule rise of 610 vehicles registers as a 0% gain.

The monthly fleet sector breakdown of July 2024 versus July 2023 sales is:

- Commercial Fleets: 68,410 vehicles were sold into commercial fleets in July 2024, compared to 71,414 in July of last year, for a decline of 4.2%.

- Rental Car Fleets: 54,439 vehicles were sold into rental fleets in July 2024, compared to 78,368 in July of last year, for a drop of 30.5%.

- Government Fleets: Fleet vehicle sales rose to 24,694 in July 2024 from 21,682 in the same month last year, rising 13.9%. (Note: Apples-to-apples comparisons with government fleet sales are not possible due to one or more OEMs not reporting any sales from month to month. In July Hyundai, Nissan, Subaru, and Toyota did not report any sales to government fleets).

The combined sales for the three fleet sectors in July totaled 147,543 vehicles, down 14% from the July 2023 total of 171,464 fleet vehicle sales.

As OEMs have ramped up post-pandemic vehicle production, more vehicle buyers are coming off the sidelines and are replacing fleet vehicles they held longer than usual in recent years.

Bobit, owner of Automotive Fleet, Vehicle Remarketing, and Auto Rental News, compiles fleet sales numbers that reflect aggregate figures from the three major Detroit-based auto manufacturers and the Asian Big 6 automakers.

Originally posted on Automotive Fleet